“Fail fast, learn faster” - this is not only a common mantra in the startup cosmos, but also a bitter reality in many cases. The road to a successful startup is rocky, full of setbacks and failed ideas. But what if the reason for failure is not the product or the market, but the founder themselves?

Recent posts by Eric Weber

7 min read

8 Founder Personas Most Likely to Fail

By Eric Weber on 06 June 2025

Topics: Startup Tips startups

6 min read

Global Venture Capital Trends 2024 insights on Startup Investment Dynamics Part 2

By Eric Weber on 20 May 2025

Our CEO and founder Eric Weber shares his latest analysis, giving you insights into what’s happening in the startup and venture capital world - globally, nationally, and at the regional level. This is the second part. Check out the first part here.

Topics: startups Venture Capital venture clienting 2025

4 min read

Global Venture Capital Trends 2024 insights on Startup Investment Dynamics Part 1

By Eric Weber on 16 May 2025

Eric Weber, CEO and founder of SpinLab – The HHL Accelerator, shares his analysis of the global venture capital landscape. Covering international, national, and regional developments, his insights reveal the shifting dynamics of startup financing in 2024 and what founders and investors need to pay attention to.

Topics: Startup Tips Venture Capital venture clienting 2025

5 min read

How does SpinLab help to identify and avoid toxic corporate structures?

By Eric Weber on 08 May 2025

90% of startups fail overall. The fact that many startups fail due to disputes within the team, a lack of capital, technical problems or low customer demand seems logical and is well documented statistically. However, deeper down and not immediately visible, it is often problems in the shareholder list (capitalization table or cap table for short) that can lead to the end. By providing resources and expertise, SpinLab, a leading European accelerator, helps startups not only to raise capital, but also to understand and effectively manage their cap table. This approach ensures that startups are well prepared to attract investment and strategically plan their business structure.

3 min read

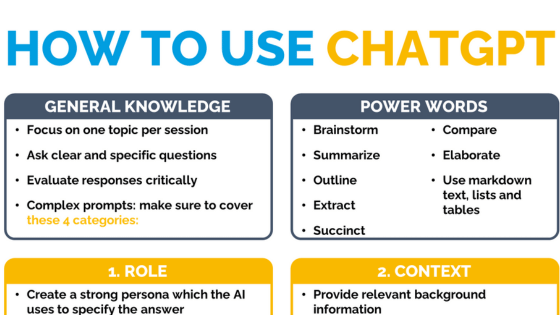

Enhancing startup grant applications with ChatGPT

By Eric Weber on 21 August 2023

Applying for grants has the potential to significantly impact startups by providing essential funds and resources for their growth. However, the application process is often intricate, demanding, and time-consuming, requiring startups to create compelling narratives, meet specific criteria, and present accurate financial projections.

Topics: Startup Tips startups

7 min read

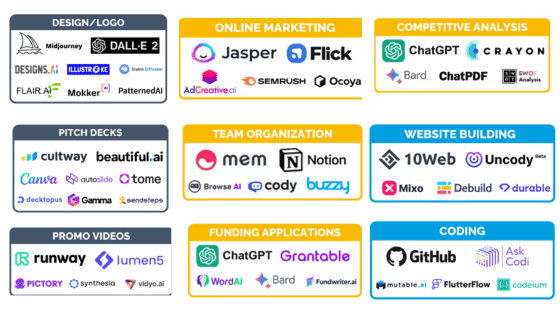

Essential AI tools every startup should know about

By Eric Weber on 19 July 2023

As a founder, you face a lot of challenges - from product development to team management to customer support. In this dynamic startup world, AI tools have become an indispensable ally for overcoming these challenges and propelling success. In this article, we introduce you to top AI tools for your startup.

Topics: Startup Tips startups

20 min read

The future of nuclear energy in Germany

By Eric Weber on 04 August 2022

Crises have been weighing on the global economy for almost two years. The energy industry in particular has been hammered by the Ukraine invasion as oil and gas imports from Russian sources are now realized with big (ethical) question marks. Rising prices, supply bottlenecks and alarmingly empty storage facilities have been the result, not only in Germany. Already in September 2019 – long before the war - the German government declared an “emergency plan” with three levels and reached level 2 (alert level) end of June 2022. At level 2, the goal is to fill gas storages by reducing gas consumption, e.g. through reducing the electricity production with gas power plants. For these reasons, the discussion on nuclear power has gained new momentum. Even the German Minister of Finance Christian Lindner - contrary to his statement from the end of 2021 - wants to rekindle a debate on nuclear power. But what does the situation actually look like and how realistic is a return to nuclear power really?

Topics: energy

6 min read

10 reasons why SpinLab is interesting for more established startups

By Eric Weber on 11 January 2022

You have come across our Accelerator program, but you are not quite sure if it is suitable for your startup? We often receive questions from established startups asking whether they still fit into the program and what added value the participation has. In this article, we will show you 10 strong arguments why established startups should definitely apply for our free program. Let's go!

Topics: Startup Tips applynow

8 min read

Guidelines to avoid broken cap tables

By Eric Weber on 20 September 2021

A cap table- short name for “capitalization table”- is a spreadsheet with an overview of who owns a portion of equity of a company and how this equity is distributed among shareholders. When entrepreneurs are looking for financing rounds, the cap table is one of the main files that investors will check to assess whether the venture has a healthy distribution of equity or not. Generally, investors prefer cap tables where all or at least the vast majority of shareholders will contribute to value creation in the future. In some cases, entrepreneurs with appealing and promising business ideas miss funding opportunities due to the so-called broken cap tables. This refers to an inadequate distribution of equity among shareholders or inacceptable terms and conditions, which generates misalignment of interests or interferes with an efficient business management. As a result, the startup losses the ability to raise funds or requires going through a painful restructuring process.

Topics: Startup Tips startups

12 min read

A step by step guide to build a cap table

By Eric Weber on 06 September 2021

When preparing financial rounds, investors usually ask for cap tables (short version for “capitalization table”). Basically, this is a list or spreadsheet with an overview of all shareholders who have a participation on your company. Sounds easy? But in fact it isn’t, especially in later financing rounds. Why? Well, in the easiest case is the simple share distribution to founders and investors round by round, but in practice the deal structures are more complex. Typically, due to special rights and agreements, the allocation of equity shares deviates from voting rights and from money proceeds distributed after a cash event like an exit (e.g. a trade sale or an IPO). Very often it is complex enough to hire (and pay) external consultants and lawyers to reproduce the contractually fixed distribution and it is a frequent discussion point in due diligence processes on that way. Thus, it is worth paying some attention right from the beginning.

.jpg)

-1.jpg)

/The%20future%20of%20nuclear%20energy%20in%20germany%20blog%20article%20unsplash%20Prometheus%20Design.jpg)

/spinlab_investorsday_hyperion_DR2_9052_20-09-17.jpg)

/Guidelines%20to%20avoid%20Broken%20Cap%20Tables.png)

/Cap%20Tables%20Guide%20Blog%20Article%202021.jpg)

/White%20Versions/stadt_leipzig_white.png?width=130&name=stadt_leipzig_white.png)

/lfca_white.png?width=119&name=lfca_white.png)

/White%20Versions/sachsen_signet_white.png?width=65&height=79&name=sachsen_signet_white.png)